Prime Loans Under 13%

Cheaper Than Banks

Looking for a smarter way to borrow in New Zealand? Say goodbye to bank rates and hidden fees and hello to low-interest loans starting at just 12.95%** – that's lower than ANZ or Westpac, designed especially for Kiwis with good credit.

Save up to 36%

And it couldn’t be easier! Right now, you could Save up to 36%* with SMB's new, lower interest rate loans, now up to $20,000.

Trusted by thousands

Excellent Trustpilot rating from 3,300+ reviews

Why Choose SMB for Your Loan?

Break free from bank hassles with SMB’s prime personal loans. Our 12.95% pa rate beats major banks, offering fast approvals, flexible repayments, and no surprises. Perfect for Auckland, Wellington, and Christchurch professionals looking to consolidate debt or fund home renovations.

*Savings are calculated based on a $2,500 loan repaid weekly over 36 months at 12.95% pa interest, compared to our previous rate of 49.95% p.a. The 12.95% rate applies to our lowest-risk customers; your actual rate may vary between 12.95% and 49.95% depending on risk factors and the amount borrowed. Total repayments, including all fees, range from $3,464.19 (at 12.95% pa) to $5,446.34 (at 49.95% pa), incorporating a $240 establishment fee and $156 in account maintenance fees.

**Our standard annual interest rates range from 12.95% to 49.95% per annum, with an establishment fee of $240 and an account fee of $4 per month (when paying monthly), $2 per fortnight (when paying fortnightly), or $1 per week (when paying weekly). Normal lending criteria and responsible lending inquiries apply.

Banks Can’t Keep Up with SMB

Our low rates and seamless process make us the smarter choice for prime borrowers. Compare us to the big banks and see the difference.

Why SMB Wins

Lender

Starting Rate pa

Lower rates, faster approvals, no hidden fees. Tailored for good credit and flexible for all Kiwis.

SMB

12.95%*

Higher rates and slower processes – why wait?

Westpac

13.90%

Bank bureaucracy vs. our quick, transparent service.

ANZ

9.95%

Competitive, but our fixed rates offer more certainly.

Kiwibank

13.90%

*Rates from 12.95% to 49.95% pa based on credit assessment.

Your Path to Smarter Borrowing

Whether you're consolidating debt, renovating your home, or tackling unexpected expenses, SMB is here with:

Bank-Beating Rates

Start at 12.95% pa** – cheaper than most banks.

Lightning-Fast Approvals

Apply online, get decisions in minutes.

Flexible Terms

Tailored repayments to suit your life.

Trusted by Thousands

4.9/5 stars on Trustpilot from happy Kiwis.

No Hidden Fees

Full transparency – what you see is what you get.

**Our standard annual interest rates range from 12.95% to 49.95% per annum, with an establishment fee of $240 and an account fee of $4 per month (when paying monthly), $2 per fortnight (when paying fortnightly), or $1 per week (when paying weekly). Normal lending criteria and responsible lending inquiries apply. Rates as of September 2025, subject to change.

Get a personal loan with SMB

-

Get peace of mind that your home is not at risk by being tied to your loan with SMB.

-

We know that your financial life can be a challenge, use this loan to get you back on the road.

-

Your payments will not increase, and instead be fixed for the duration of your loan.

-

Not secured against your home

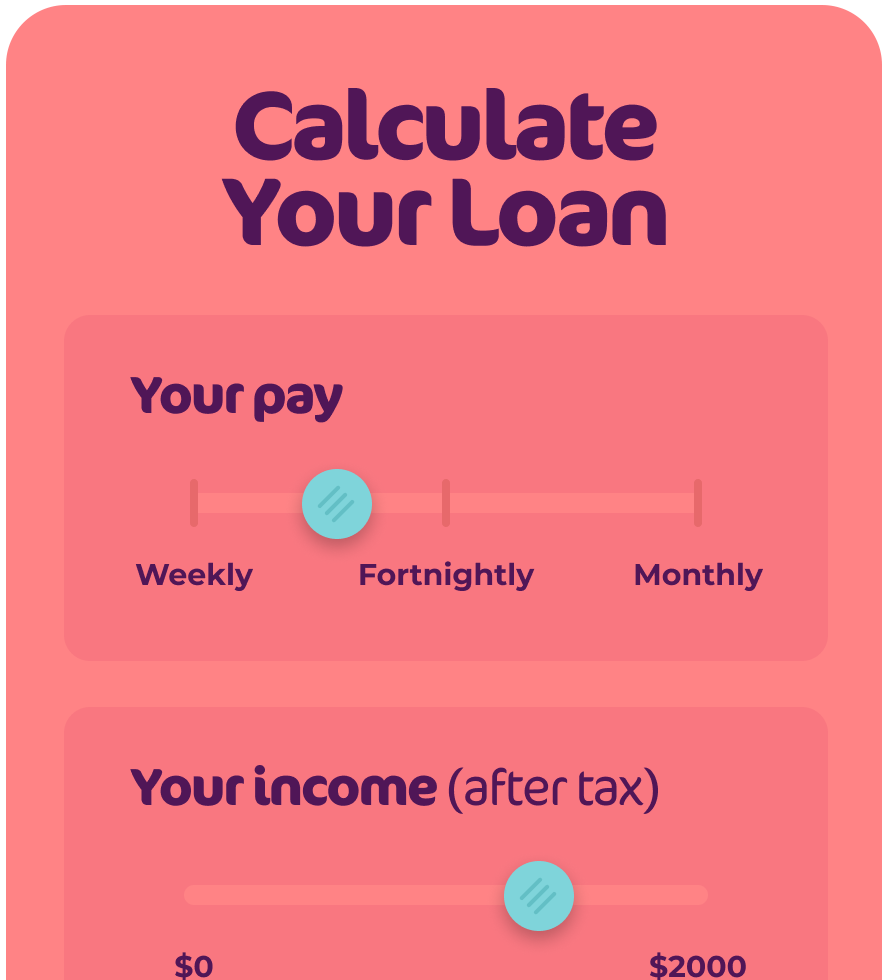

Payment schedule that suits you (weekly, fortnightly or monthly)

Helps your credit score

Approval - typically less than 24 hours

No Interest on missed payments

Financial advice and Guidance

Weekly webinar sessionsDiscount on completion of first loan

Valued customer discountService Guarantee

Cancel and repay your loan at any time… no feesPersonal Guarantee

If you get in trouble, we will treat you like a person with empathy and dignity.

-

Pay down faster

Earn Repayment Holiday (coming soon)

Earn Emergency Loan (coming soon)

-

Get peace of mind that your home is not at risk by being tied to your loan with SMB.

-

We know that your financial life can be a challenge, use this loan to get you back on the road.

-

Your payments will not increase, and instead be fixed for the duration of your loan.

-

Not secured against your home

Payment schedule that suits you (weekly, fortnightly or monthly)

Helps your credit score

Approval - typically less than 24 hours

No Interest on missed payments

Financial advice and Guidance

Weekly webinar sessionsDiscount on completion of first loan

Valued customer discountService Guarantee

Cancel and repay your loan at any time… no feesPersonal Guarantee

If you get in trouble, we will treat you like a person with empathy and dignity.

-

Pay down faster

Earn Repayment Holiday (coming soon)

Earn Emergency Loan (coming soon)

-

Get peace of mind that your home is not at risk by being tied to your loan with SMB.

-

We know that your financial life can be a challenge, use this loan to get you back on the road.

-

Your payments will not increase, and instead be fixed for the duration of your loan.

-

Not secured against your home

Payment schedule that suits you (weekly, fortnightly or monthly)

Helps your credit score

Approval - typically less than 24 hours

No Interest on missed payments

Financial advice and Guidance

Weekly webinar sessionsDiscount on completion of first loan

Valued customer discountService Guarantee

Cancel and repay your loan at any time… no feesPersonal Guarantee

If you get in trouble, we will treat you like a person with empathy and dignity.

-

Pay down faster

Earn Repayment Holiday (coming soon)

Earn Emergency Loan (coming soon)

Ready for a Smarter Loan?

Join thousands of Kiwis choosing SMB for fast, reliable, and affordable loans. Apply now for a secure, transparent process – perfect for professionals with strong credit in Auckland, Wellington, Christchurch, and beyond.

*Savings are calculated based on a $2,500 loan repaid weekly over 36 months at 12.95% pa interest, compared to our previous rate of 49.95% p.a. The 12.95% rate applies to our lowest-risk customers; your actual rate may vary between 12.95% and 49.95% depending on risk factors and the amount borrowed. Total repayments, including all fees, range from $3,464.19 (at 12.95% pa) to $5,446.34 (at 49.95% pa), incorporating a $240 establishment fee and $156 in account maintenance fees.

**Savings are calculated based on a $5,000 loan repaid weekly over 36 months at 12.95% pa interest, compared to our previous rate of 29.95% p.a. The 12.95% rate applies to our lowest-risk customers; your actual rate may vary between 12.95% and 49.95% depending on risk factors. Total repayments, including all fees, range from $6,482.75 (at 12.95% pa) to $10,273.38 (at 49.95% pa), incorporating a $240 establishment fee and $156 in account maintenance fees.

***Savings are calculated based on a $10,000 loan repaid weekly over 36 months at 12.95% pa interest, compared to our previous rate of 29.95% p.a. The 12.95% rate applies to our lowest-risk customers; your actual rate may vary between 12.95% and 49.95% depending on risk factors. Total repayments, including all fees, range from $12,519.84 (at 12.95% pa) to $19,927.06 (at 49.95% pa), incorporating a $240 establishment fee and $156 in account maintenance fees.

We’re here to make it easy

Same-day funding

Get your funds as quickly as the same day your loan is approved so you can get moving ASAP.

Not secured to your home

Our rates may be higher than a bank, but we don’t secure against your home.

Trusted by 30,000 Kiwis

And with over 3,368 5-star reviews, know you’re in good hands.

★★★★★

3,300+ 5-star Reviews

24/7

The SMB Loan

Improve your credit score

🏡

Not secured against your home

😉

Pay off faster with one-off payments

30,000+ Customers

😍

Up to $20,000

Tips and

ideas on

how to save

⏰

Draw-down in as little as 24 hours

🥇

1 simple fixed rate

Apply in 7 mins

NZ Call Centre

⌛️

Top-ups in 5 minutes

Personal loans for hassle-free funds, fast

Same-Day Funding

Not secured against your home

Lump sum payments help you pay off debt faster

Top-rated (5-Star) personal loans

Fixed Rate

Loans up to $20,000

Your loan could be just three steps away

Our standard annual interest rates are 12.95% - 49.95%, with an establishment fee of $240 and a monthly account fee of $4. Normal lending criteria and responsible lending enquiries apply.

FAQs

-

Our personal loans help fund life’s smallest to biggest moments. Our products are designed to provide customers with access to competitively priced credit whenever and wherever they need it.

Take a look to see whether you qualify for a loan and and take a look at our loan products here.

-

Making your loan repayments on time, leads to a brighter tomorrow through positive credit reporting! SMB has partnered with credit bureau Equifax to ensure customers benefit from paying their loans on time. Making your payments on time will positively impact your credit score, which is a great way to get your score moving in the right direction.

Want to know more about what your credit score is and how positive credit reporting works? Check out our article here.

-

We know your loan is important to you, so we work hard to get it to you quickly! If your loan is approved on a business day, we will make payment to your bank on the same day.

The exact time that funds will become available to you will depend on your bank, but it should be within a few hours post approval!

We'll keep you updated on the status of your application by email and text, and you can also call our friendly customer team FREE on 03 288 2562 to discuss the status of your application.

Click here for more information on our loan application process.

All loan applications are subject to responsible lending inquiries.

-

You sure can!

Basically, a top-up is a new loan, just with a portion of the funds being used to settle your previous loan balance.

You just need to make sure the top-up is enough to clear your existing loan balance AND cover off what you need the new loan for.

The amount you can top-up by is dependent on your individual circumstances! Each top up request for additional funds is subject to a full credit assessment.

What we look at when we assess your top-up loan application:

You have a history of making payments on time on your current Flex Loan

That the new loan remains affordable and there has been no significant change in your circumstances including changes in income, expenses and other financial commitments

The new loan continues to meet your requirements and objectives

You have demonstrated good account behaviour reflecting a responsible borrower. This means your bank statements don't show:

Reversals to other credit and/or utility providers

Transfers and withdrawals causing reversals

Problem gambling impacting your ability to meet payment obligations

-

You can request an early repayment at any time at no extra cost or penalty!

Please call our repayments team FREE on 03 288 2562 before making an extra payment so we can provide you with the exact balance to pay and adjust your repayment schedule if necessary.

Click here for more information on repaying your loan.

-

We want to ensure you have the best borrowing experience possible and we have a number of options available to keep you on track. We encourage you to contact us if you can’t make a payment – we can talk about your options and adjust your repayments!

Our friendly repayments team are here to help – give them a call FREE on 03 288 2562 or send an email to repayments@smb.nz

We understand that sometimes you can struggle financially, we are here to help you! Although it can be tempting to just ignore the situation and hope things will improve for the better, missing a payment may hurt your credit score! If you feel things might get out of control or if your individual situation has changed, all you need to do is give us a call and we can help protect your score, and work together to find a repayment solution that is suitable.

Click here for more information on repaying your loan.

Click here for more information on financial hardship.